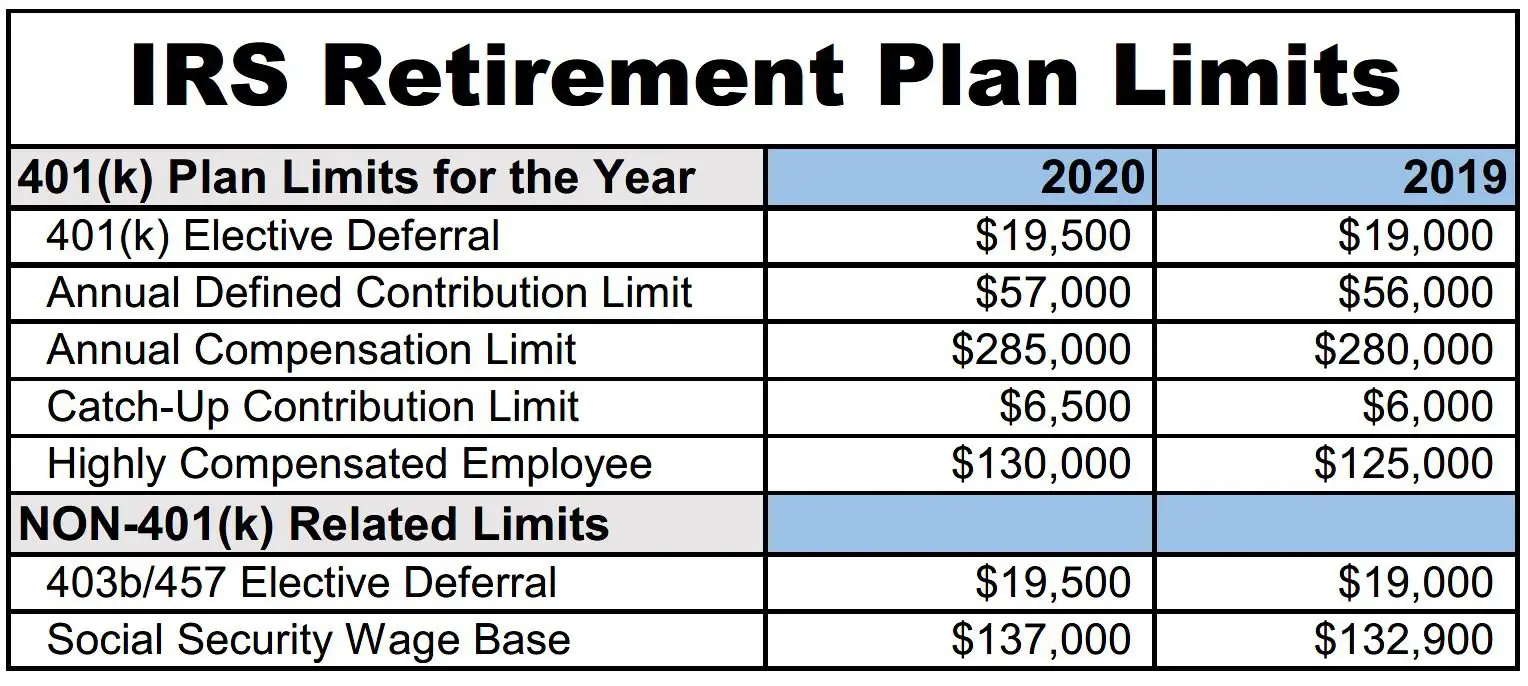

401 K Limits 2025 Catch Up. In 2025, the maximum you can invest in your 401 (k) is $23,000, and this doesn't include any employer matching contributions. Individuals can contribute up to $23,000 total into their traditional or roth 401(k) plans in 2025, no matter how high their income is that year.

The limit on employer and employee contributions is $69,000. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

401k Limits 2025 Catch Up Lissy Phyllys, (it 2025, it's $22,500.) (it 2025, it's $22,500.) plan participants who are 50 or older at the end of the calendar year can make an.

What Is The 401k Catch Up Limit For 2025 Ardyce Jerrie, (it 2025, it's $22,500.) (it 2025, it's $22,500.) plan participants who are 50 or older at the end of the calendar year can make an.

401k Contribution Limits 2025 Catch Up Aggy Lonnie, The limit for overall contributions—including the employer match—is 100% of your.

2025 401k Contribution Catch Up Limit Tedi Abagael, Individuals can contribute up to $23,000 total into their traditional or roth 401(k) plans in 2025, no matter how high their income is that year.

401 K Contribution Limits 2025 Catch Up Florry Shelia, The income levels used to determine eligibility for ira contribution.

401k Limits 2025 Catch Up Age Birgit Steffane, The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

Roth 401k Contribution Limits 2025 Catch Up Melly Sonnnie, “this will show an increase in taxable wages.

2025 401k Contribution Limit And Catch Up Dollie Leland, Beginning in 2025, workers will be allowed to contribute up to $23,000 to their 401 (k), an increase of $500 from this year.